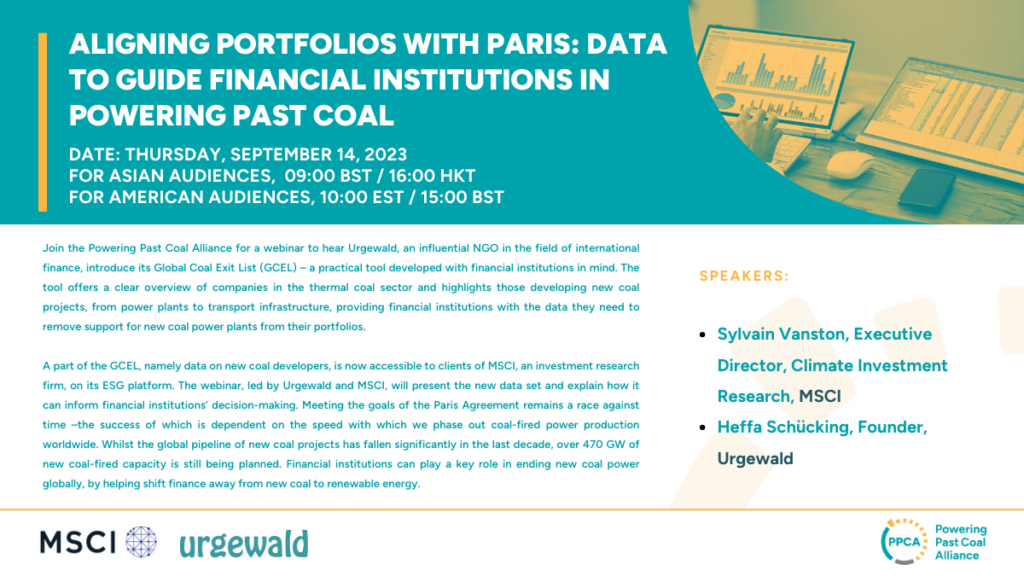

The Powering Past Coal Alliance hosted a webinar to hear Urgewald, an influential NGO in the field of international finance, introduce its Global Coal Exit List (GCEL) – a practical tool developed with financial institutions in mind. The tool offers a clear overview of companies in the thermal coal sector and highlights those developing new coal projects, from power plants to transport infrastructure, providing financial institutions with the data they need to remove support for new coal power plants from their portfolios.

A part of the GCEL, namely data on new coal developers, is now accessible to clients of MSCI, an investment research firm, on its ESG platform. The webinar, led by Urgewald and MSCI, presented the new data set and explained how it can inform financial institutions’ decision-making. Meeting the goals of the Paris Agreement remains a race against time –the success of which is dependent on the speed with which we phase out coal-fired power production worldwide. Whilst the global pipeline of new coal projects has fallen significantly in the last decade, over 470 GW of new coal-fired capacity is still being planned. Financial institutions can play a key role in ending new coal power globally, by helping shift finance away from new coal to renewable energy.

Speakers:

- Sylvain Vanston, Executive Director, Climate Investment Research, MSCI

- Heffa Schücking, Founder, Urgewald

Background:

- In the second half of 2022, the total amount of new coal power capacity under consideration dropped below 100 GW for the first time since data collection began –but there is still work to do.

- Meeting the goals set out in the Paris Climate Agreement is a race against time, the success of which is dependent on the speed with which we phase out coal-fired power production worldwide.

- Since the Paris Climate Agreement was signed, the world’s installed coal-fired capacity has increased by 157 GW, to the equivalent to the operating coal plant fleets of Germany, Russia, Japan and Turkey combined. Over 470 GW of new coal-fired capacity is still in the pipeline.

- Project developers, financiers and governments all recognise that new coal infrastructure no longer makes sense, as it is not cost-competitive with renewable energy. It is already cheaper to generate electricity from new renewables than from new coal plants in all major markets.

- Only a handful of developing countries are still adding significant coal capacity to their energy mix. Further development of coal as the most polluting energy source could render the 1.5ºC goal impossible.

- New coal power plants are often falsely presented as a source of cheap, reliable power. However, there is a high likelihood that today’s coal investments are tomorrow’s stranded assets that developing nations cannot afford. Investing in new coal is a bad decision for the climate and a bad decision for economic development and energy security.

- PPCA finance members, who represent over US $17 trillion in assets, are responding to the call to drive and boost momentum for global efforts to phase out emissions from coal power needed to meet Paris Agreement targets. But implementing this can come with challenges and the Alliance stands ready to actively support financial institutions in their coal-to-clean transition.