Coal is the most important fuel in electricity generation today, accounting for 38% of global power production. Its use, however, is set to peak in 2027 and slide thereafter. The contribution of coal might drop to just 11% by 2050, as low-cost renewables, more flexible gas and cheap batteries push in and reshape the electricity system. Decreases in coal generation in almost all countries, including in large economies that are heavily reliant on coal today, will drive the global decline of the fossil fuel.

The fundamental change of the role of coal in the power system is one of the key findings of BloombergNEF’s long-term outlook for the future of electricity, the New Energy Outlook 2018. The report aims to find answers on what the cheapest power system in the future might look like, analyzing the competitiveness of energy technologies and their ability to meet electricity demand. The analysis draws its conclusions without factoring in aspirational government targets that may accelerate the transition, such as coal phase-outs, and subsidies that might favor renewables over fossil fuels.

Coal loses the cost race against solar and wind

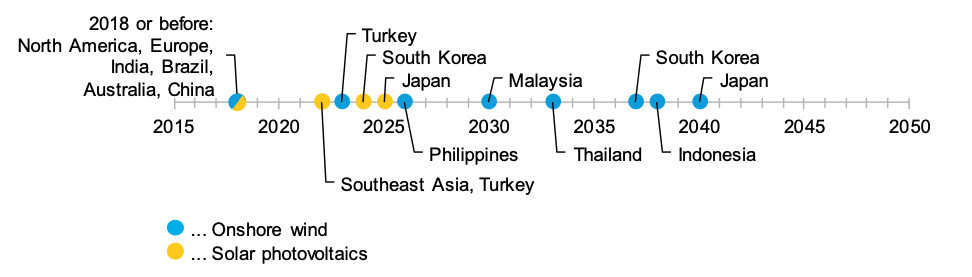

The quickly falling costs of solar and onshore wind, and the limited capability of coal power plants to operate flexibly alongside variable renewables, herald the decline of coal power. In North America, Europe, India, Brazil and Australia electricity from new, unsubsidized wind and solar photovoltaic power plants is already cheaper than new coal. In China, where coal represented 40% of capacity additions between 2015 and 2017, the costs of recent solar photovoltaic projects are now on par with those of new-build coal and will start to undercut them from 2019. In most of Southeast Asia, this happens by 2022, and by 2025 it happens in Japan.

Prospects are dim for coal to match solar and wind’s cost cuts achieved from better manufacturing, economies of scale and improving efficiency. In many economies, capital costs of new coal power plants have increased with the introduction of more complex technology to limit air pollution. At the same time, improvements in minimizing energy losses in coal-based electricity generation are slowing. This is because gains in efficiency of steam turbines – the machines that convert the thermal energy of coal into mechanical energy – are ever harder to achieve as the technology further matures.

Figure 1. When solar and wind become cheaper than new coal power plants

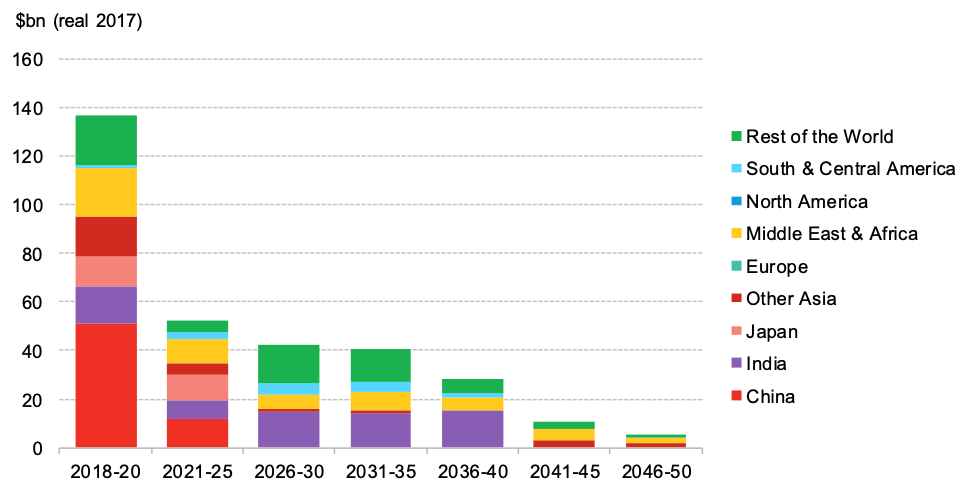

Because of coal’s worsening cost competitiveness against solar photovoltaics and wind, new coal build is set to drop in all markets. Around 355GW of new coal plants, equivalent to $190 billion of investments, still get commissioned out to 2025. Many of these are legacy projects that were planned and financed many years ago, predominantly in China and India. Yet, by the middle of the next decade, annual additions of new coal power start to plunge. On average, the world adds less than 5GW of new coal per year between 2025 and 2050, compared with an average 78GW between 2015 and 2018. China, Europe, North America, Brazil, Australia and South Korea are among the regions that add zero coal after 2025. India continues to invest in the fuel until the early 2040s, mostly for system security reasons, adding about half of the global coal capacity, worth $45 billion, between 2026 and 2050.

Global installed coal capacity reaches its maximum at 2,107GW in 2022, before dropping by an average of 46GW per year out to 2050 as plant retirements exceed additions. By 2050, only 5% of all the power generating capacity installed worldwide runs on coal compared to almost a third today.

Figure 2. Global investments in coal by region, 2018-2050

Generation and emissions peak in 2027

Coal generation peaks at 9,900TWh five years after capacity has reached its maximum, driven by a second cost dynamic: when it becomes cheaper to build a new onshore wind or a solar photovoltaic plant than to run an existing coal plant. Both China and the U.S. are critical in this regard. China will account for 51% of global coal generation that year, and the U.S. will have 6% – at which point solar and wind PV begin to undercut the operating costs of their existing coal power plants, squeezing coal’s run hours and accelerating the closure of old, inefficient generators. Between 2027 and 2040, global coal generation declines 2% each year on average, and 5% per year in the decade to 2050. By mid-century, coal generates only one in nine kilowatt-hours needed to meet demand.

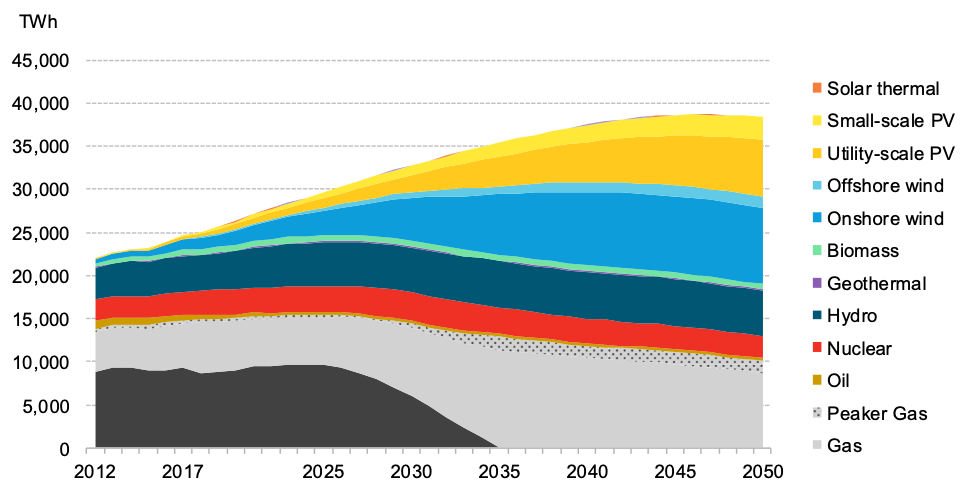

As the share of variable renewables increases, the limited flexibility of coal power plants to quickly adjust their load to wind and solar output further aggravates the fossil fuel’s challenging position in a transformed power system. Batteries and so-called peaker gas generators help with the integration of renewables by providing flexibility to the power grid, and the primary purpose of coal shifts from providing bulk electricity around-the-clock to energy provision during nighttime hours and extreme periods of low generation and high demand not met by renewables.

Power sector emissions go hand-in-hand with coal generation and also peak in 2027. Coal, gas and oil power plants emit around 13.6 gigatons of carbon dioxide in that year – an increase of 2% relative to 2017 levels. Coal emissions account to 10.5 gigatons in 2027. By 2050, power sector emissions decline to 8.5 gigatons, of which 4.7 gigatons are coal.

Despite an aggressive increase of renewables and concurrent decline of coal in this scenario, emissions are nonetheless far from limiting global warming to 2 degrees Celsius above pre-industrial levels. By 2050, cumulative emissions overshoot the power sector’s carbon budget 86% or 180 gigatons of carbon dioxide. For warming to stay below 1.5 degrees, the electricity sector would need to abate another 63 gigatons relative to the 2 degrees pathway – or 243 gigatons compared with a lowest-cost power system – becoming effectively carbon-neutral at around 2050. Thereafter, the Intergovernmental Panel on Climate Change (IPCC) suggests that the sector might even need to remove carbon from the air to avoid further warming.

Phasing out coal with policy means more gas, some more renewables

In a scenario where governments phase out coal worldwide between 2025 and 2035, both gas and renewables would see faster growth than in a power system optimized around meeting demand at least cost. Gas generation would increase and take up about 73% of the void, which in turn would require adding 51% more generation by 2050 than in the least-cost scenario. An extra 1,196GW of new gas plants would provide this electricity. An additional 715GW of solar and wind, aided by 531GW of additional utility-scale batteries, make up the rest of the gap left by coal – which is equivalent to 11% more generation than if coal was not phased out.

Eliminating coal and replacing it with a least-cost combination of renewables, batteries and gas pushes emissions down to 5.2 gigatons of carbon dioxide or 54% below the least-cost system trajectory in 2035. This is somewhat good news from a climate perspective, as this emissions level would bring the world close to a 2 degrees Celsius trajectory in the medium term. The gap to a 1.5 degrees Celsius would still be substantial, though, with emissions needing to be cut by another 43% just through 2035 and an extra 93% in the period to 2050. The IPCC projects that climate-related risks to health, livelihoods, food security, water supply, human security, and economic growth would increase significantly even if global warming reaches 1.5 degrees.

Simply getting rid of coal will not be enough to keep the earth on track for 2 or 1.5 degrees in the longer-term. For this, an earlier, faster and more aggressive abatement of emissions would be required. Policies that effectively cut emissions beyond just coal’s, ambitious energy saving and efficiency measures as well as new zero carbon technologies that can decarbonize gas at scale or supplant its role in the power system are some of the available options to achieve this goal.

Figure 3. Evolution of the global generation mix under a coal phase-out scenario

This story is based on the New Energy Outlook 2018, BloombergNEF’s long-term analysis of the evolution of the global power system. Updated annually, the report compiles, updates and forecasts data on costs, energy prices, capacity, generation and emissions.