By Leonard Quong at Bloomberg NEF

Coal generation has long been the bedrock of Australia’s electricity supply, providing abundant, cheap baseload power to consumers. But the fleet is ageing and is faced with a series of economic battles for its long-term survival – battles the coal plants are unlikely to win.

Introduction

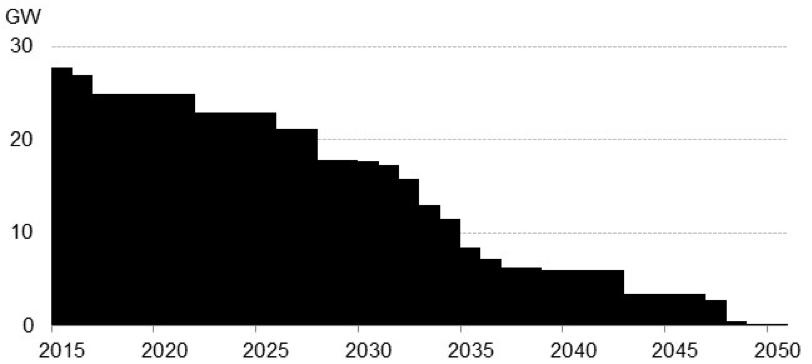

Age, and the effects of it, are at the heart of the problems facing Australian coal-fired generators. With an average age of 29 years, compared to a design life of between 40 and 50 years, Australia’s coal fleet is ageing. By 2050, nearly all of the country’s 25GW of coal capacity operating today will reach the end of their technical life, with almost 50% reaching this point between 2030 and 2040. Since 2016, already 2.8GW of coal capacity has retired due to old age or after encountering market conditions they were not designed to operate in.

Figure 1. Australian coal capacity with closure at end of technical life (Source: BloombergNEF)

With demand for electricity expected to continue growing, any gap in electricity supply left by retiring coal projects has to be filled. The rapidly changing economics of generation, and needs within the system, will determine Australia’s future generation mix.

Coal unlikely to fill supply gap

There are three main ways to fill the inevitable gap in supply left by retiring coal: i) build new coal plants, ii) life-extend the existing plants as they age, or iii) build something else.

Building new coal

Despite an abundance of coal reserves in Australia, building a new coal-fired power station is one of the most expensive forms of electricity generation. The market views building new coal as an extremely risky prospect. As a result, investors and debt providers demand a significantly higher rate of return for investments in coal projects. The three main risks are:

- Carbon risk: Since the repeal of the Carbon Tax in 2014, Australia has lacked any long-term, robust, national decarbonization policy. Investors worry that any future policy or decarbonization mechanism will strand investments in new coal.

- Market risk: The volatile nature of Australia’s electricity markets leaves coal generators particularly exposed to rapidly fluctuating electricity prices, changes in demand dynamics, and fuel prices increasingly linked with international commodity markets.

- Risk to reputation: Many Australia-based companies are reluctant to support any green-field coal plants due to increasing environmental, social and governance exemplarity expectations (and at times demands) from consumers, investors and shareholders. Already, most large domestic banks have ruled out financing any new coal projects in the country.

Due to these factors, there is very little appetite for any new coal generation projects within Australia’s investment community. Prospective developers struggle to de-risk projects and maintain a viable business model over the life of the project without relying on generous government support schemes (where none yet exist).

Life-extending coal

Extending the lifespan of a coal plant refers to investing new capital into an existing project to keep it operating beyond its initial end-of-life. Each plant will require different investments to continue operating, but even so the ability to life-extend Australia’s coal fleet is limited. Two asset owners, AGL Energy and Origin Energy, have already committed to closing down the coal plants they own at the end of their life – ruling out extending any of these projects. While this might not sound too significant, between the two them, these companies own 39% (10GW) of Australia’s existing coal capacity.

About 8GW of the existing fleet would face severe economic barriers to having their operation extended, according to our analysis. These barriers include poor plant conditions, limited access to fuel supply, limited waste disposal options, or simply an inability to extend environmental permits. The poor condition of the coal fleet is also causing plants to trip, a technical failure that is more likely to happen during episodes of extreme heat that are increasingly frequent. For example, on January 18, 2018, the 500MW Loy Yang B plant, Australia’s youngest lignite power station, tripped whilst supplying around 6% of the state of Victoria’s power demand. The gap in supply was successfully compensated for by the system but these episodes are challenging the portrayal of coal plants as the most, or even only, reliable source of electricity by supporters of the sector in Australian politics.

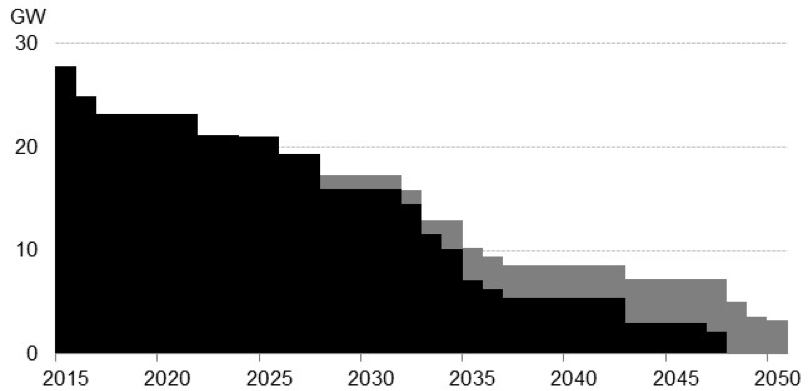

Taking into account company commitments and poor life-extension economics, only 7GW of coal projects operating today stand to be life-extended. Even if each of the projects that have any reasonable potential for a 15-year extension got one, there would still be a significant gap in supply left by retiring coal (Figure 2).

Figure 2. Australian coal capacity with closure at end of technical life with possible life extensions (Source: BloombergNEF)

Build something else

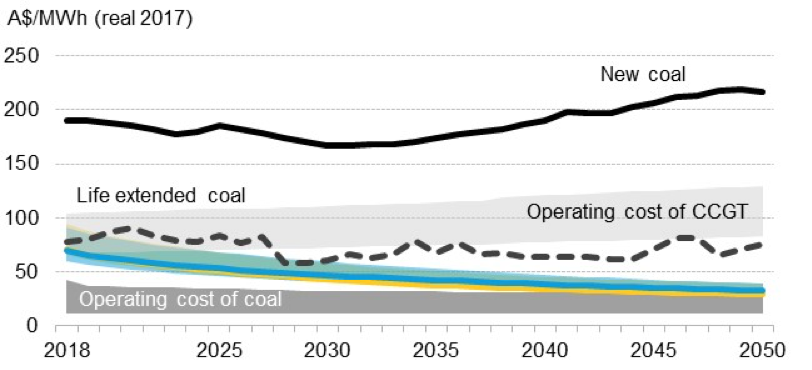

A mix of renewables, along with other flexible technologies, will be the most likely source of new generation in the market as coal projects retire. For years now, building new renewable generation has been the cheapest source of new electricity supply in Australia. Currently new large-scale wind or solar generation costs around A$55-90/WMh to build in Australia, with future costs expected to continue to decline.

Figure 3. Levelized cost of generation (Source: BloombergNEF)

Operating coal is cheap, but building new coal is one of the most expensive sources of new generation, at around A$190/MWh, taking into the cost of capital expected by investors. The cost of life-extending coal projects is more uncertain, with each project requiring a different amount of re-investment to continue operating. Our analysis suggests that projects reasonably placed to life-extend could do so for around A$81/MWh.

When coal plants retire, there will be no perfect solution to plug any gaps in supply. The market will have to rely on price signals and perceived risks to determine the optimum mix of higher usage of existing assets, building new low cost generation, and flexible capacity.

More renewables require more flexibility

Most of the thermal plants operating today were built at a time, and with a budget, that did not value flexibility in coal generation. As these coal plants approach the end of their technical lives, what flexibility they had often decreases. Newer coal generation technologies have improved flexibility to some extent, but the rapid influx of renewables is challenging coal generation on two new fronts:

- Demand following: Physically and thermally, large coal generators struggle to ramp their electricity output quickly. Historically, more expensive gas or liquid fueled ‘peaker’ plants were used to balance fast changes in electricity demand. However, as more variable renewable energy generators enter the market, the complexity of this challenge grows. Coal’s inability to ramp quickly means it is unlikely to be rewarded for the much more difficult task of balancing variable demand against increasing amounts of variable supply.

- Price following: At high levels of penetration, renewable energy generators suppress wholesale prices when they are operating, particularly in the middle of the day when small- and large-scale solar capacity is at full production. Older, inflexible coal power plants are unable to turn off during these periods, without remaining off during higher morning or evening price events, meaning that coal plants could be frequently exposed to very low or even negative prices.

In the nearly 10 years since the last new coal plant was commissioned in Australia, the country has installed around 6.3GW of solar on its rooftops and what will soon to be 11GW of large-scale renewable projects on the grid. With the amount of variable renewable generation in the energy mix expected to grow, it’s likely many coal plant owners will find themselves faced with a challenging economic situation before their technical end of life.