By Colleen Regan at Bloomberg NEF

Xcel Energy, a large energy company with utilities stretching across the U.S. Midwest, is accelerating its transition to clean energy. After relying heavily on coal, natural gas and nuclear for most of its history, Xcel has made a recent push to decarbonize, leveraging its territories’ strong winds and solar irradiance levels. Its strategy aims to reduce greenhouse gas emissions by 60% from 2005 levels by 2030 and 100% by 2050, retiring multiple gigawatts of coal-fired power in the process.

Once one of the largest owners and operators of coal-fired power plants in the United States, Xcel has firmly pivoted toward renewable energy. Its current CEO, Ben Fowke, has noted that “it’s not a matter of if we’re going to retire our coal fleet in this nation, it’s just a matter of when.” (Bloomberg News, “Coal Plants Keep Shutting Despite Trump’s Order to Rescue Them”, June 18, 2018.) Its self-described “steel for fuel” strategy seeks to displace these aging coal-fired units with a portfolio of low-cost wind and solar, complemented by flexible natural gas and batteries.

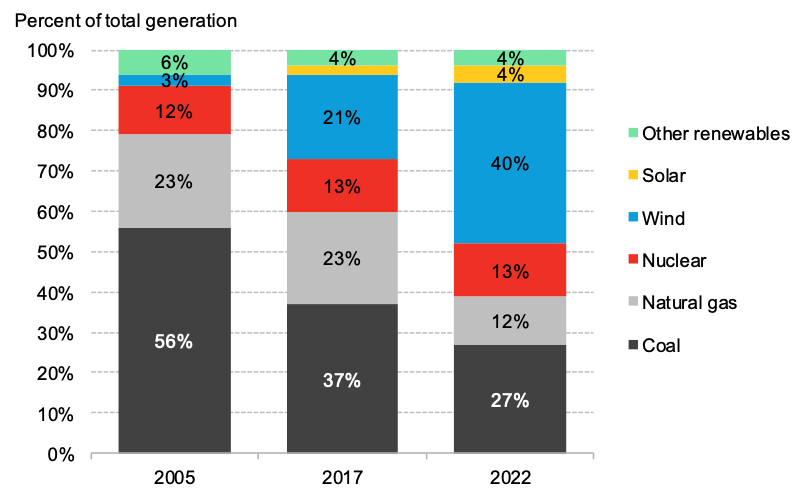

Since 2005, Xcel’s carbon footprint has shrunk 35%, putting it well on the path to hit its 2030 target of a 60% decline. By 2022, it expects coal and natural gas – which made up 79% of its mix in 2005 – will represent only 39% of generation. Wind energy will be the primary source that displaces these fossil assets, generating 40% of Xcel’s power.

Figure 1. Xcel generation portfolio in 2005, 2017 and 2022 (expected). (Source: Xcel Corporate Responsibility Report)

State policy was the primary impetus for Xcel’s move into renewable energy: for example, Minnesota’s renewable portfolio standard requires Xcel to source 30% of its retail sales from renewable energy by 2020, including a 1.5% carve-out for solar. A similar target in Colorado pushes for 27% renewables, plus a 3% target for distributed generation, by the same year.

But state policy drivers have slowly given way to economic stimuli. Xcel’s four regulated utilities cover some of the country’s best wind resources, straddling the blustery Great Plains, as well as robust solar resources in Colorado, Texas and New Mexico.

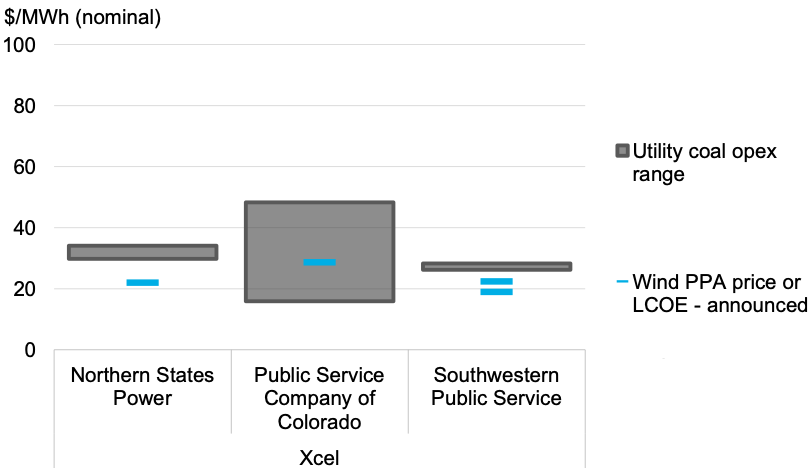

Falling technology costs and federal tax credits, together with these strong resources, have allowed Xcel’s request for proposals (RFPs) for new wind farms to fetch prices under $22/MWh in its Northern States Power (NSP-System) territory, which includes its two utilities in Minnesota and Wisconsin. Even better, its Southwestern Public Service Co. in Texas and New Mexico secured new wind bids at $19/MWh. These wind prices are very attractive: in both NSP-System and Southwestern Public Service territories, they undercut the operating costs of Xcel’s coal-fired units, while in Colorado, recent wind prices have been competitive with its coal-fired fleet.

Figure 2. Operating costs of Xcel’s coal units versus announced wind PPA price or LCOEs. (Source: Xcel, Bloomberg NEF)

Already the largest producer of wind generation among the country’s electric utilities, Xcel plans to build – and own – at least an additional 3.6GW of wind capacity. Its various utilities commissions have approved these plans, meaning that Xcel will earn a return on these capital expenditures of about 9.5-10%. The ability to earn returns on renewable energy investment (as opposed to merely passing along costs, as Xcel does when it signs a power purchase agreement for renewable energy – meaning someone else earns a return) is another key driver for Xcel in ramping up its renewable energy build.

In Colorado, its utility proposed – and received approval from the public utilities commission in August 2018 – to close the 660MW Comanche coal power plant from 2022-25, a decade earlier than planned. Xcel will instead invest $2.5 billion across 1,100MW of wind, 700MW of solar and 275MW of battery energy storage; along the way, it expects to save customers $213 million. Retiring the coal plants is a key part of Xcel’s cost-savings plan: fewer outlays on fuel will save on operating costs, and the transmission lines and interconnections left open by Comanche’s retirement will reduce installation costs for renewables. Xcel expects these actions to reduce its Colorado emissions by 60% below 2005 levels by 2026, four years early, at no incremental cost to customers. At the same time, it expects renewable energy generation will rise to 55% of its portfolio.

The shift away from coal by U.S. utilities is due to a confluence of factors, including competition from low-priced natural gas and renewables, aging boilers, and increasingly effective opposition from the local communities impacted by coal plant pollution. As a result, coal provided only 30% of electricity in 2017. This figure contrasts with its 49% share 10 years earlier in 2007 and represents the lowest share held by coal in at least the past 70 years.