By Bryony Collins at Bloomberg NEF

From insurers to royalty-holding companies, investing in coal is becoming a riskier venture. Stricter regulation on coal imports in China and carbon emissions is making holders of these assets start to question the lifetime and long-term potential for the industry in a world where environmental protection is becoming more center stage.

Coal plant economics are also shifting. In many major markets including Germany, India, the U.S. and China, solar and wind energy plants are already cheaper than building new large-scale coal and gas plants, according to BloombergNEF’s New Energy Outlook 2018. And by 2030, the economic “tipping point” will occur almost everywhere, the report says.

Technology improvement and cost reduction in batteries will mean that intermittent wind and solar plants will increasingly be able to run when natural resources are lacking, which will eat into the most valuable operating hours for fossil fuel plants including coal, according to BloombergNEF. The research group expects some 1,290 gigawatts of new batteries to come online globally between now and 2050.

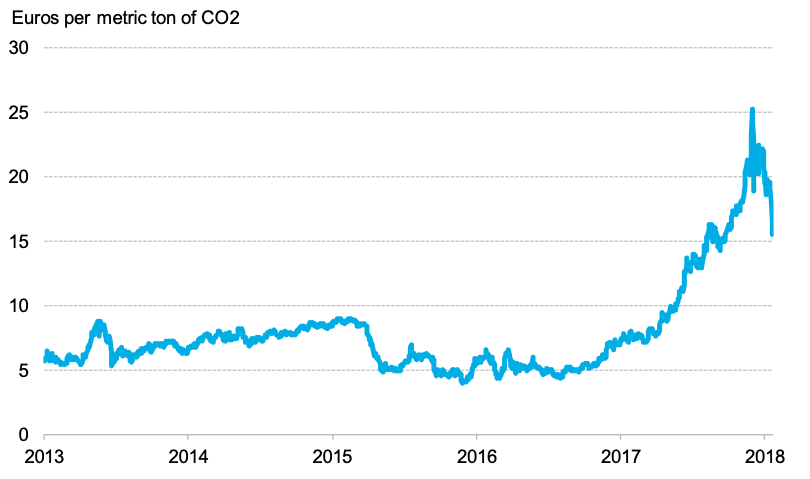

Added to this, the price of allowances on the European Union carbon market have doubled in the past year and they are now trading at around 20 euros per metric ton. This places a higher cost on emitters of CO2 in the bloc and creates further associated risk for insurers and investors.

Figure 1. EUAs double in past year

The prospect of worsening economics for coal does not bode well for investors, and many are reducing their exposure to the commodity.

Coal royalties

Five years ago, coking coal accounted for all the income of Anglo Pacific Group, compared to just 42% of the company’s income now, Julian Treger, chief executive of the London-based natural resource investor, told BloombergNEF in an interview. The company has been diversifying into commodities like vanadium, nickel, cobalt and copper in line with a clean energy future, he said.

Anglo Pacific will continue to reduce its exposure to coal, and in particular to coal with high ash content that is very polluting. “Those types of coal are becoming less valued and are proving to be poor investments,” in comparison to “high quality, less polluting coal, which the world seems to be valuing more” and is currently “extremely lucrative”, said Treger.

Monthly contracts for coal at the Newcastle coal terminal in Australia are currently trading at five-year highs, while the price of coking coal is at a ten-year high in China, said Treger. High temperatures over summer 2018 in China and other Asian countries boosted air conditioning demand and led to a growth in demand for power. A “lack of investment for new coal production has meant that existing coal mines are enjoying a windfall,” he said. Around four-fifths of Anglo Pacific’s coal investments are in coking coal for steel production, and one fifth in thermal coal for power generation, he said.

Anglo Pacific holds royalties in the Kestral coal mine in Australia that sells premium coal to China for prices that are 50% higher than typical on the market, said Treger. It is important that Anglo Pacific invests in coal that exceeds the specifications of the Chinese market, he said. Both Australian mines where Anglo Pacific has invested plan to expand significantly because the owners see growing demand for premium coal in Southeast Asia, he said.

Anglo Pacific sees exposure to coal declining naturally over time, due to mine depletion, even without diversifying into other commodities. Taxation on carbon emissions is also discouraging the use of less efficient coal, said Treger.

Glencore Plc expects investment in more than 107 gigawatts of coal plants, equivalent to more than 220 new coal-fired units over the next 15 years, in markets dependent on seaborne-traded thermal coal. Global energy demand from markets seeking low-cost power supply will continue to support the company’s coal mining business and fully utilize coal reserves, according to Glencore’s 2017 climate change report. However, on February 20th 2019 Glencore announced that it would limit coal production to current levels of about 150 million tons per year, in response to pressure from shareholders to improve its environmental performance. The company will focus new investment on mining commodities that support the clean energy and transportation future.

Insurance

European insurers in particular are moving away from insuring coal projects and the companies behind them. Since 2015, some 17 major insurance companies have divested from coal, withdrawing an estimated $30 billion from the sector, according to the Unfriend Coal campaign.

More than 100 financial institutions globally have introduced policies to restrict funding for coal, according to the Institute for Energy Economics and Financial Analysis. Since 2013, coal exit announcements have occurred at a rate exceeding one per month from banks and insurers with over $10 billion of assets under management, according to a report from the institute.

In a recent announcement from a bank, BNP Paribas plans to divest from companies deriving more than 10 percent of revenue from coal and to implement carbon intensity limits on power generators.

In May 2018, Allianz announced that it would no longer provide standalone insurance for coal plants or coal mines, and that it would ban all companies planning to build more than 500 megawatts of new coal capacity from its investment portfolio. And other insurers have joined suite, including AXA and Swiss RE, as the damaging environmental effect of burning coal for energy becomes increasingly perceived as an unsustainable investment.

However, U.S. companies AIG, Liberty Mutual, Chubb and Berkshire Hathaway continue to insure coal projects around the world, which demonstrates that the divestment movement has some way to go. AIG declined to comment on coal investment for this research.

The 40 largest U.S. insurers hold more than $450 billion in coal, oil, gas and electric utility stocks and bonds, according to Insure Our Future, a campaign against U.S. companies insuring and investing in coal and tar sands projects. U.S. insurers continue to financially prop up the coal industry, despite paying out in claims as a result of extreme weather events exacerbated by a changing climate. Wildfires in Northern California generated $12.6 billion in insurance claims in 2017, and that year’s hurricane season accounted for more than $200 billion in damages, according to an announcement from the campaign in September.

Insurance companies are starting to factor in the potential impact of climate change when making underwriting and investment decisions, but there is a lack of transparency as to how this applies to coal investment among some.

The reinsurance market also has an important role to play in reducing financial backing from the coal industry. The withdrawal of the biggest reinsurance companies would “challenge the expansion of the coal sector and hasten its phase-out,” said a briefing from the Unfriend Coal campaign in September 2018.

Swiss Re is the only reinsurer to take significant action on coal, having announced in July that it will no longer provide cover to companies or projects which rely on coal for more than 30% of their revenue or more than 30% of the power they generate. Munich Re has also announced a new policy regarding insuring business in coal, but it is unclear how far this approach would extend to industrialized countries that account for less than 8% of new coal capacity planned or under construction, states the Unfriend Coal campaign. Divestment efforts often exclude a particular region, or only apply to companies with investment over a certain amount, so the case for outlying coal is a complex endeavor.

The more reinsurance companies join the divestment effort, the more difficult it will become for companies to continue to derive significant revenue from burning coal. The controversial Ostroleka C coal plant in Poland, which has a capacity of 1 gigawatt, is a case in point. The plant would operate from 2023 to 2063 – far beyond the timeline for phasing out coal in line with the Paris agreement – but it will require insurance in order to operate, and an underwriter prepared to take on board the associated potential risks.

Poland has pledged to the EU that the Ostroleka project will be the last coal plant that it builds in order to meet the bloc’s carbon reduction commitments. In December, project owner Energa and Enea were awarded 15 years of subsidies in a capacity auction to build Ostroleka. The energy ministry viewed the project as important for power supply security and the need to synchronize the Polish power grid with the Baltic States. Winning the subsidies was necessary for the project to proceed to investment, the owners said. However, obtaining bank loans to fund the project may prove difficult as financial institutions scale down their support for coal investments, said Krzysztof Tchorzewski, Poland’s energy minister, cited in a Bloomberg News article.